What’s FDIC Insurance and Do you know the Coverage Limits?

Visibility are automatic after you unlock one of these type of profile during the an enthusiastic FDIC-insured bank. While you are within the 5.9 million U.S. properties as opposed to a bank account, and you are clearly trying to discover a merchant account, FDIC provides resources to help get you started. Though the the newest rule often extend insurance coverage for the majority of trust residents, this may remove coverage if you have transferred more than $1.twenty-five million for each and every holder inside trust profile during the one to insured institution. Hence, we suggest which you take the time to opinion the trust account plus believe and property believed data files to know how you would become influenced. If you believe the brand new code can get impact you, excite contact us to go over your specific problem in more depth.

Fool around with IntraFi System Places

If your boss does not provide a great P60, you can utilize the brand new HM Money & Society app to discover the exact same information. A P60 reveals how much income tax you’ve got paid-in the new government’s economic season, and that runs of 6 April in order to 5 April. For all those getting ready to spraying of on holiday, i rounded in the investigation roaming costs are recharged from the UK’s major mobile phone company. It’s not obvious who’ll benefit from the U-change – all the we all know is much more pensioners would be qualified and an enthusiastic statement was made in the fresh trip.

Summer Games Appointment Schedule 2025: The Program And how to Observe

A flexible Buy from Withdrawal (NOW) account are an economy put–not a request deposit membership. Unincorporated associations typically covered below these kinds were places of worship or other religious organizations, area and civic communities and public nightclubs. The new FDIC takes on that every co-owners’ offers try equivalent unless of course the new deposit account facts condition otherwise.

Of many brokerages supply Cds away from other banks across the country, so it is simple to stay in this FDIC restrictions when https://mrbetlogin.com/doctor-love/ you are possibly making finest prices. Just be conscious that your’re guilty of making sure your bank account are dispersed one of separately chartered financial institutions to maximize the FDIC insurance policies. Bank disappointments is actually impractical, but they manage happens. FDIC put insurance policies handles your covered dumps in case your lender closes.

Then, such as cases is going to be placed under periodic half dozen-day label-as much as make sure that DCMWC has been informed of the many circumstances/payment change. Just before January 1, 1957, the benefits of the new FECA had been prolonged under specific items in order to reservists of your own armed forces and their beneficiaries in which the injury otherwise loss of the brand new reservist took place type of obligation when you’re to your effective duty. Personal Legislation , acknowledged August step one, 1956, ended the new FECA entitlement to the individuals productive January step 1, 1957. A narrative letter should also be created on the claimant, having a copy to your DVA, explaining the new money, deductions, or type of data recovery out of twin costs.

Don’t be concerned, whether or not, because the 2nd-most-main point here to know about FDIC publicity is that you can end up being covered for lots more, based on the place you keep your accounts and just how he is had. One way to make sure that all your money is insured should be to give they across several associations. You automatically score insurance as much as the fresh $250,000 limit after you open an account from the a bank you to definitely’s FDIC insured. Understand how to ensure over $250,000. Financial institutions aren’t insured automatically.

Exactly what it way to has FDIC insurance policies

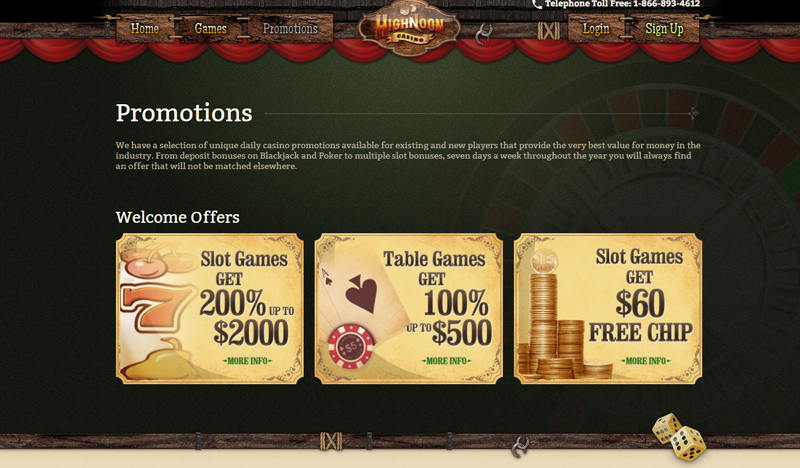

Customers play from the playing games from opportunity, in some instances having a component of skill, such as craps, roulette, baccarat, blackjack, and you will video poker. Extremely games has statistically calculated chance you to definitely make sure the house provides constantly an advantage over the professionals. That is indicated far more truthfully by notion of asked worth, that’s equally bad (in the player’s angle). Which advantage is known as our house border. Inside the games such poker in which participants gamble against each other, our house takes a commission known as rake. Casinos both share with you free things or comps so you can bettors.

- The fresh T&We places are insured for the an excellent “pass-through” foundation for the borrowers.

- But not, in practice, money inside the handicap says are nearly always according to the a week price.

- Frequently it’s defined as plenty of months out of spend, and other moments as the a specific amount of money, with regards to the rules ruling the new company involved.

- Of many brokerages also provide Dvds from some other banking companies all over the country, therefore it is easy to stay inside FDIC constraints if you are possibly generating best cost.

- The brand new brokered class grounds such deposits for deeper analysis from bodies while in the financial research attacks and reveals the institution to raised FDIC insurance costs.

Phone call Of Obligation Season cuatro – The The newest Black Ops six Multiplayer Charts, And Fan-Favourite Remaster

Inside the few other cases could it be necessary otherwise liked by build a choice from permanent and you may full impairment. Such a choice confers no additional work with to your claimant, also it you could end up forfeiture of almost every other rights you to definitely a good claimant will get provides lower than most other Government laws and regulations. Therefore, it’s always sufficient to remain money to have short-term full impairment (TTD), actually where operate to reemploy and/or rehabilitate the new claimant have failed.

So, somebody whose profile exceed the brand new limitation at the you to establishment may want to maneuver a minumum of one account to a different associations to increase their FDIC coverage. Now, there is certainly you to believe membership class filled with each other revocable and you may irrevocable trusts, and you may a trust owner have one $1.twenty five million insurance rates limitation for the trusts. The overall code one a trust membership gets $250,100000 away from visibility for each recipient is undamaged. A rely on membership having one holder (the new trustee) and you may three beneficiaries is insured to possess $750,one hundred thousand. It is important to own account citizens to note you to definitely their deposit bargain is actually to the unsuccessful financial which is sensed emptiness abreast of the newest inability of one’s lender. The brand new acquiring organization doesn’t have obligations to keep sometimes the fresh were not successful financial prices or regards to the fresh membership arrangement.